Earlier this month, over 1,000 people gathered for the annual North Atlantic Seafood Forum in Bergen, Norway. With participants from 32 countries, five continents, and nearly 400 organisations, the conference involved three days of discussions, networking and industry insights. Key issues in salmon farming were discussed as part of a packed programme that also included a networking evening reception.

I had a great time catching up with familiar faces, making new connections and enjoying the presentations. Bringing together leading experts and important policymakers, the conference highlighted vital developments shaping the future of salmon farming and provided insights on a range of subjects from technology and AI to feed ingredients, markets and challenges. It was an opportunity to gain a valuable perspective on innovation and commercial development in the salmon sector, and increase understanding of the financial and economic issues affecting markets today.

Cage Talk

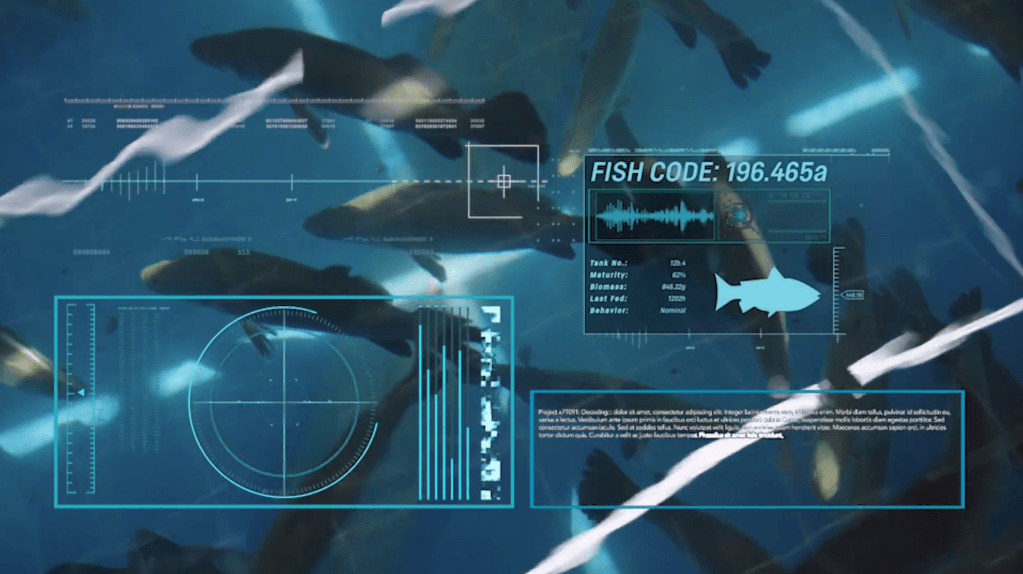

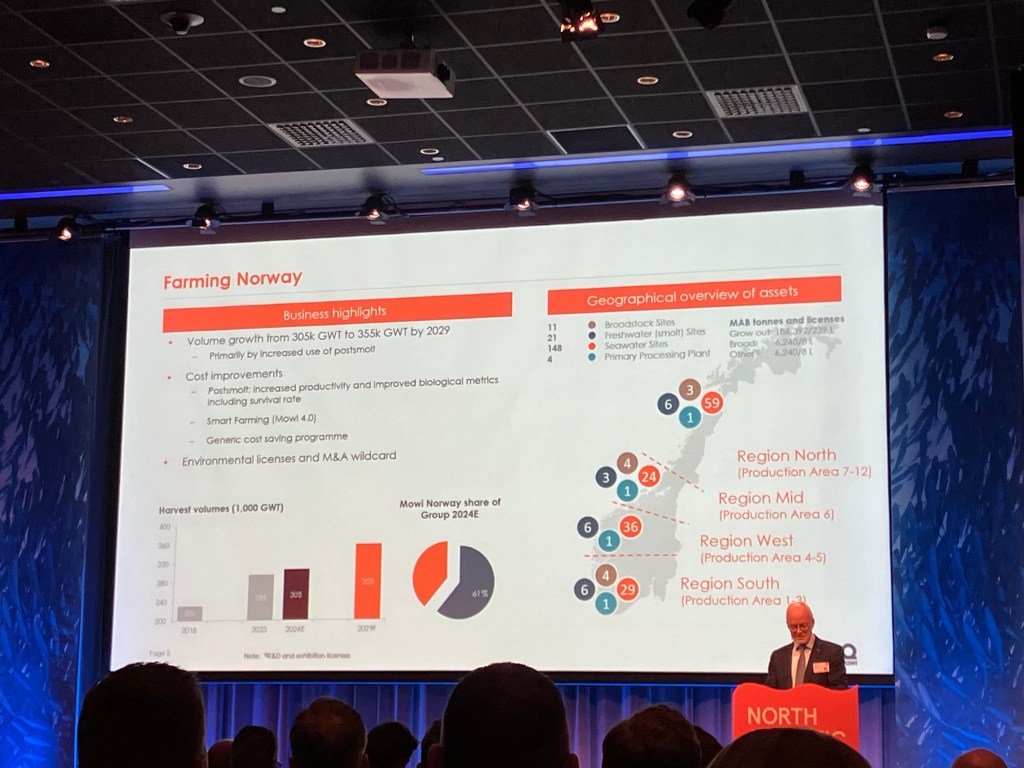

The first day of the conference looked at addressing the challenges of farming salmon at sea through technology, best practices and innovation. The Cage Talk session first discussed the importance of rearing smolt on land for longer to reduce the amount of time the fish spend at sea. This has an array of advantages, according to Oyvind Oaland, chief of farming operations at seafood firm Mowi in Norway and Iceland. He explained that as a result, sea lice treatments can be reduced and site capacity and survival can increase. During a presentation from salmon farming company Cermaq, Harald Tackle introduced the company’s use of 50m-deep skirts in Tofino, Canada, to address sea lice, and the use of laser technology on salmon farms in Norway to control sea lice and reduce the need for treatment.

During this session, and indeed throughout the entire conference, the word collaboration featured prominently. The salmon sector needs to work closely with authorities to establish further regulations towards sustainable growth, and work with academia and researchers to develop science-based, objective knowledge and information to address key challenges. Skilled engineers are also important to drive ocean innovation systems that can support growth. The salmon sector has many stakeholders with their own expertise who can contribute across the value chain, streamlining operations, reducing environmental impact or ensuring good living conditions for fish. Collaboration between stakeholders can drive these positive steps, allowing the industry to grow and improving other areas, including consumers’ access to sustainable seafood options.

Focus on Feed

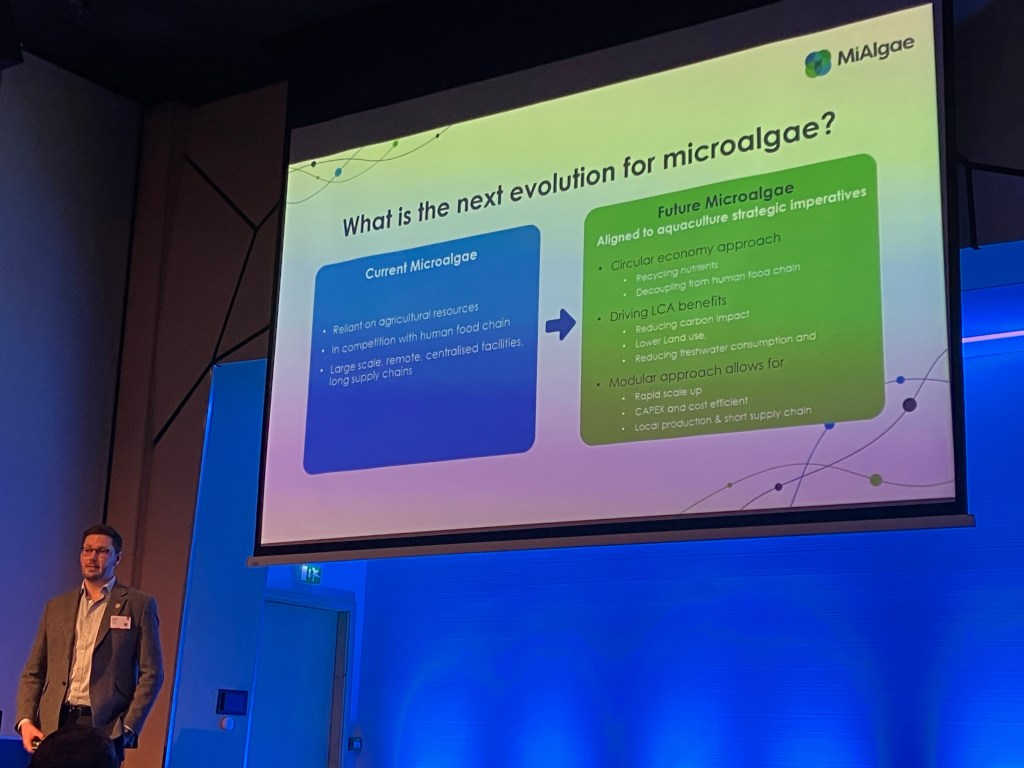

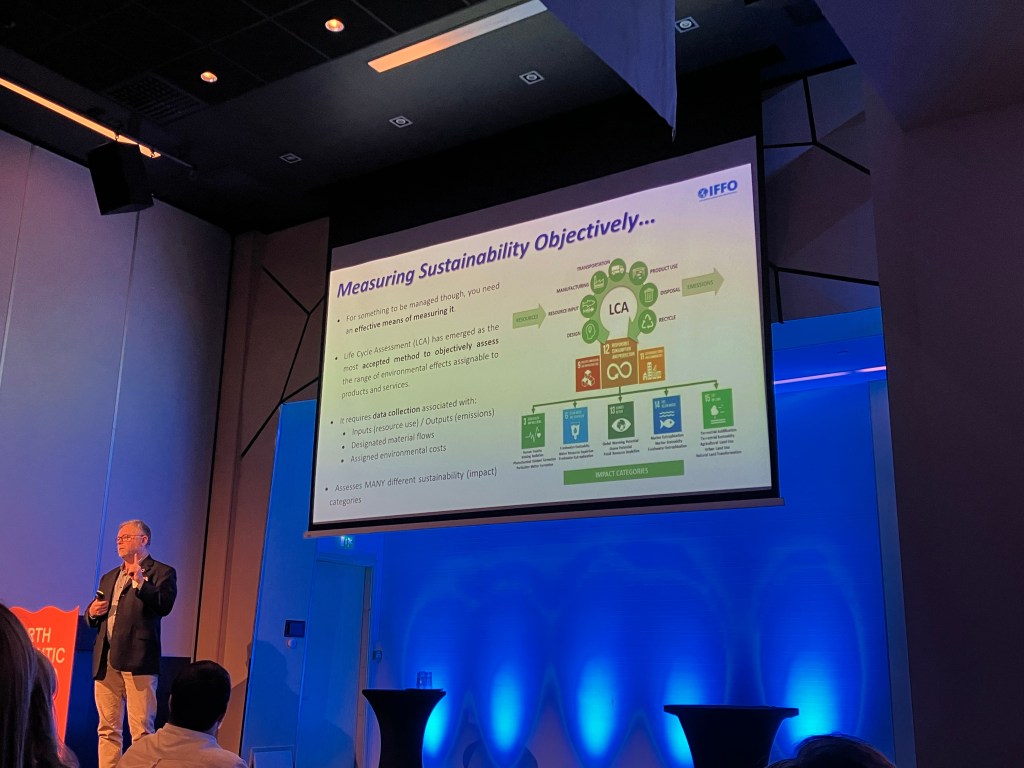

Feed was once again on the menu this year, with a strong focus on the role of feed ingredients in environmental impacts assessment and mitigation, life cycle assessment and nutritional balance to ensure fish health and growth. There is already plenty of proof and innovation in salmon farming showing that alternative feed ingredients like algae, insects and single cell proteins are reliable and viable. In fact, the conference made it clear that these ingredients are already playing a part in de-risking the supply of essential nutrients for feed, while the salmon sector’s commitment to incorporating such ingredients is strong. During the presentations, Skretting introduced a matrix for novel ingredients, while Biomar Norway shared its data from 2024 on inclusion rates of microalgae (2.4%) and other ingredients such as insects (2.18%).

It was also noted that the focus on alternative feed ingredients is not about replacing marine ingredients, but rather adding to them. However, it is up to the entire value chain to generate real impact, and create reliable markets for alternative feed ingredients to ensure that they can scale. During the feed sessions, some examples of steady leadership were highlighted, such as Cermaq’s commitment to sustainable feed, while Marco Custodio, project manager at consultancy Earthworm Foundation, touched upon the need to understand consumer attitudes towards alternative ingredients before market creation and scale up. He described consumer surveys that have been carried out in France, highlighting the need to conduct such studies to align with market expectations and improve transparency and communication with consumers.

Another main point raised during the feed sessions is that supply must expand. Algae innovators have already added 10% to global EPA and DHA supply, but not just for aquaculture. Meanwhile, the availability of insect meal is growing, but slowly. Can the examples presented at the conference continue to develop, and work to build a more sustainable future for feed?

Salmon Welfare

I always enjoy discussions on animal welfare in aquaculture, so it was great to see an entire session devoted to this topic. Salmon Welfare in Aquaculture showed that with Norwegian seafood exports reaching record levels in 2024, ensuring fish health is essential to maintaining consumer trust, regulatory confidence, and operational efficiency. The morning consisted of two panels talking about industry risk and sustainable growth through change management. They provided solutions-oriented discussions, while exploring the challenges and opportunities of fish welfare from various perspectives. Once again, the key message was collaboration, and the need to work together to shape the future of ethical, sustainable salmon farming.

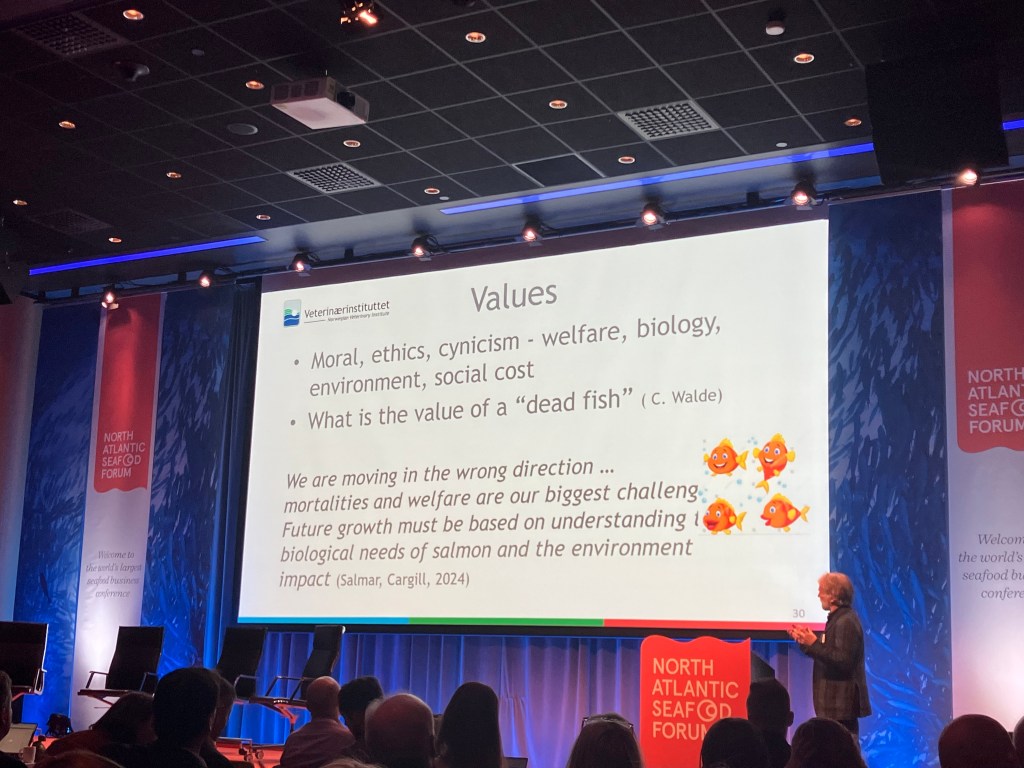

It was also interesting to hear whether fish health and welfare might have been sacrificed on the road to long-term success. Edgar Brun, academic director of Fish Health and Welfare Institute, asked this question and gave quite a strong assessment on the state of salmon health today, calling out poor crisis management and a reluctance to engage with critics.

But at the same time, the salmon farming sector clearly understands that despite the many challenges, good welfare is the only option, that this is at the heart of the trust equation and that the sector must demonstrate evidence of tangible improvements to maintain its social licence to operate. Examples of how salmon farms could take a step forward included improving understanding of welfare and what to look out for when it comes to good and bad welfare, being prepared for possible changes, and making a commitment to adapt. A nice touch during the session was a presentation by Hilde Talseth, CEO of leading broiler chicken producer Norsk Kylling. She explained what her company has done to improve the welfare of its chickens and create better rearing environments, and said that farmers, who interact daily with animals, are the true experts in identifying health and welfare issues firsthand, so building trust with them is extremely important. She also touched upon the theme of collaboration and the need to foster this to drive meaningful progress.

This year’s conference came with many more presentations and interactive discussions that covered more than what I’ve described, but they all focused on a single message – the importance of a collaborative approach to promote growth in a sustainable manner and within planetary boundaries. I also believe that the full potential of salmon farming, or indeed aquaculture as a whole, can be realised with greater collaboration between industry, regulators, academia, researchers, businesses, producers, consumers and more. A common understanding and vision will make it possible to promote a vibrant and attractive sector going forward.

*Next year’s North Atlantic Seafood Forum will take place in Bergen, Norway, from the 3rd to 5th March 2026.